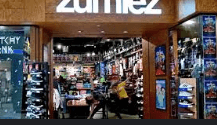

Zumiez Net Worth: How Much Is the Retailer Worth?

As of October 2023, Zumiez has established itself as a formidable player in the action sports retail sector, bolstered by a diverse range of products and a strategic emphasis on online sales. The company’s financial health appears robust, but the nuances of its net worth are influenced by various market factors and competitive dynamics. Understanding the layers behind Zumiez’s valuation not only highlights its current standing but also raises questions about its future trajectory in an ever-evolving retail landscape. What might these insights reveal about the retailer’s potential for sustained growth?

History of Zumiez

Zumiez, a prominent retail chain specializing in skateboarding, snowboarding, and streetwear apparel, was founded in 1978 in Seattle, Washington.

Originally operating as a single skate shop, it evolved into a national brand recognized for its niche focus on youth culture and action sports.

The company’s origins are deeply intertwined with skate culture, reflecting the dynamic lifestyle and aspirations of its target demographic.

See More: Zyra Gorecki Net Worth: How Much Is the Actress Worth?

Current Market Overview

The retail landscape in which Zumiez operates is characterized by evolving consumer preferences, increased competition from both traditional and online retailers, and a growing emphasis on sustainability and brand authenticity. Current market trends indicate a shift towards experiential shopping, necessitating detailed retail analysis to navigate these dynamics effectively.

| Market Trends | Implications for Zumiez |

|---|---|

| Rise of e-commerce | Need for robust online presence |

| Sustainability focus | Aligning products with eco-friendly practices |

| Experience over products | Enhancing in-store experiences |

Financial Performance Analysis

A comprehensive analysis of Zumiez’s financial performance reveals key trends in revenue growth, profit margins, and overall market positioning that are crucial for understanding the company’s sustainability and future prospects.

Scrutinizing financial metrics, including net income and operating expenses, alongside a thorough profitability analysis, illustrates how Zumiez navigates market fluctuations.

This approach ensures strategic investments to enhance its competitive edge and long-term viability.

Zumiez’s Revenue Streams

Zumiez’s revenue streams are primarily driven by its apparel sales, which have consistently performed well within the action sports market.

Additionally, the company has established a significant presence in the skateboard equipment sector, catering to a niche audience that values quality and brand loyalty.

Furthermore, the growth of online retail has enabled Zumiez to expand its reach and enhance overall sales, reflecting a strategic adaptation to changing consumer behaviors.

Apparel Sales Performance

Apparel sales constitute a significant portion of Zumiez’s overall revenue streams, reflecting the company’s strategic focus on lifestyle-oriented products that resonate with its target demographic of action sports enthusiasts.

Skateboard Equipment Market

The skateboard equipment market represents a vital revenue stream for Zumiez, complementing its apparel sales and enhancing its appeal to the action sports community.

By aligning with emerging skateboard trends and targeting specific consumer demographics, Zumiez effectively captures the interests of both novice and seasoned skateboarders.

This strategic focus not only boosts sales but also solidifies the brand’s commitment to the skateboarding lifestyle.

Online Retail Growth

Online retail has emerged as a significant component of Zumiez’s overall revenue strategy, driven by an increasing consumer preference for digital shopping experiences and the brand’s robust e-commerce platform.

Competitors in the Retail Space

In the competitive landscape of retail, Zumiez faces significant challenges from various key players that cater to similar demographics and lifestyle preferences.

A comprehensive retail landscape analysis reveals that competitors such as PacSun and Tilly’s employ diverse competitor strategies, including enhanced online presence and exclusive brand collaborations, to capture market share.

These dynamics necessitate a continual reassessment of Zumiez’s positioning and strategic initiatives.

Factors Influencing Valuation

Competitive pressures from retail rivals like PacSun and Tilly’s highlight the need for Zumiez to carefully evaluate various factors influencing its valuation, including market trends, consumer behavior, and financial performance metrics.

Key elements such as brand loyalty significantly impact consumer trends, driving purchasing decisions.

Additionally, understanding shifts in consumer preferences allows Zumiez to align its offerings, ultimately affecting its market positioning and financial health.

Recent Growth Trends

Recent growth trends for Zumiez reveal a multifaceted approach to enhancing its market position, evidenced by robust sales performance and strategic market expansion initiatives.

Additionally, the brand’s increasing online presence has played a crucial role in attracting a broader customer base.

Analyzing these factors provides insights into the company’s adaptive strategies in a competitive retail landscape.

Sales Performance Analysis

Zumiez’s sales performance has demonstrated notable resilience and adaptability in the face of shifting consumer preferences and evolving market dynamics.

Recent reports indicate consistent sales growth, reflecting the retailer’s ability to navigate emerging market trends effectively.

Market Expansion Strategies

Building on its successful sales performance, the company has implemented strategic market expansion initiatives aimed at capitalizing on emerging consumer trends and increasing its geographical footprint. By pursuing market entry in underserved regions and emphasizing geographic diversification, Zumiez aims to enhance its brand presence.

| Strategy | Focus Area | Objective |

|---|---|---|

| Market Entry | Underserved Areas | Increase brand reach |

| Geographic Diversification | New Regions | Broaden customer base |

| Trend Capitalization | Youth Culture | Align with consumer preferences |

Online Presence Growth

The growth of online presence has become a critical component of Zumiez’s business strategy, reflecting the increasing shift towards digital engagement among consumers, particularly within the youth demographic.

Through targeted digital marketing initiatives and robust social media campaigns, Zumiez has successfully enhanced brand visibility, fostering community engagement and driving sales.

This strategic focus on online platforms positions the retailer favorably within the competitive retail landscape.

Future Projections

Future projections for Zumiez indicate a potential for growth, driven by evolving consumer preferences and an expanding online retail presence. Market predictions suggest that if the retailer capitalizes on these trends, it could significantly enhance its profitability.

| Factor | Impact on Future Growth |

|---|---|

| Online Sales Expansion | High |

| Consumer Trend Adaptation | Moderate |

| Brand Collaboration | High |

Summary of Key Insights

Analyzing Zumiez’s strategic positioning reveals critical factors influencing its net worth, including its adaptability to market trends and the emphasis on enhancing online sales.

From an investment perspective, the retailer’s robust brand valuation stems from its strong community engagement and diverse product offerings.

These elements not only bolster financial performance but also enhance investor confidence in Zumiez’s long-term sustainability and growth potential.

See More: Ronnie Milsap Net Worth 2023: A Look at the Country Legend’s Wealth

Conclusion

In conclusion, Zumiez’s net worth exemplifies a harmonious blend of strategic innovation and market resilience, akin to a well-executed skateboard trick that seamlessly combines skill and creativity.

The retailer’s ability to navigate competitive pressures while expanding its online presence and engaging with communities underscores its robust financial performance.

As emerging consumer trends continue to shape the retail landscape, Zumiez’s diverse revenue streams and adaptive strategies position the company favorably for sustained growth and long-term success.